The Future of Consumer Finance: Introducing Bookafy

The consumer finance industry is undergoing a dramatic transformation as new digital technologies open up a world of possibilities. This is especially true when it comes to customer booking and scheduling appointments, where online appointment scheduling can make the process easier, more efficient, and more profitable. This is where Bookafy comes in. Bookafy is a powerful online appointment scheduling tool that can help consumer finance companies take their business to the next level.

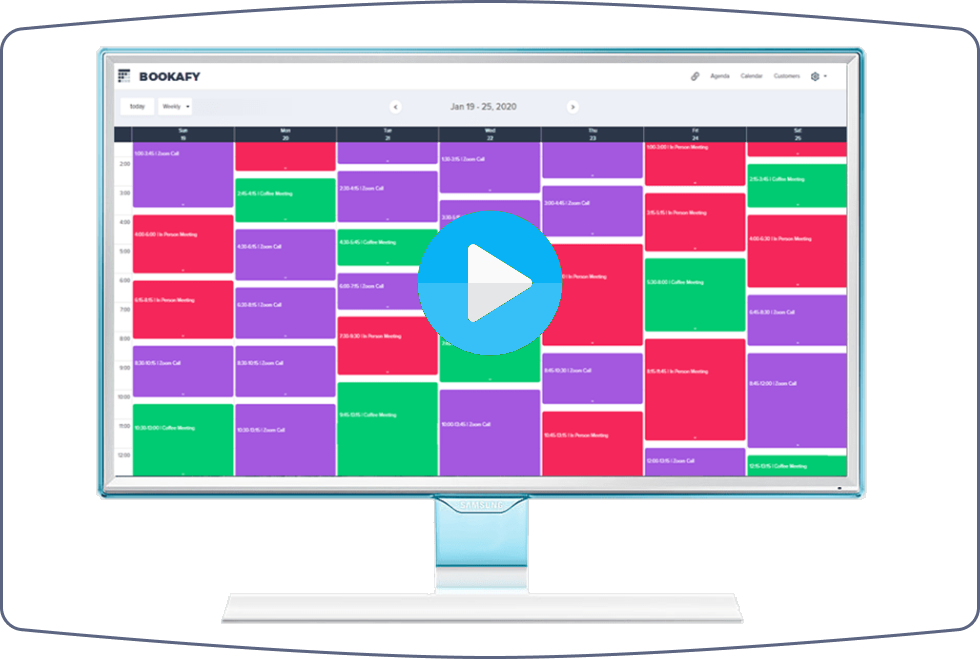

Bookafy provides an all-in-one solution for customer appointment booking and scheduling. Its intuitive interface allows customers to easily book appointments and set reminders, while the company can manage customer data and appointment scheduling from one centralized dashboard. This makes it easier for companies to manage customer appointments, freeing up valuable time and resources that can be better spent elsewhere.

The Benefits of Using Bookafy for Consumer Finance

When it comes to customer booking and scheduling, Bookafy can provide a number of benefits to consumer finance companies. For starters, Bookafy can help increase customer engagement by allowing customers to quickly and easily book appointments. This can result in increased customer loyalty, as customers are more likely to return to a company where they can easily book an appointment.

Bookafy also provides the flexibility to customize the customer booking and scheduling process. Companies can use the tool to create customized booking and scheduling processes that suit their unique needs. This can help streamline the customer booking and scheduling process, making it easier for companies to manage customer appointments and stay organized.

Using Bookafy to Optimize Your Business

Bookafy can be used to optimize business operations in a number of ways. First, Bookafy can be used to automate customer booking and scheduling processes, eliminating the need for manual data entry and freeing up valuable time and resources. This can be especially beneficial for smaller companies that don’t have the resources to dedicate to manual appointment booking and scheduling processes.

In addition, Bookafy can be used to generate reports and insights that can help companies better understand their customers and their booking and scheduling patterns. This can help companies create better customer experiences and optimize their operations to better meet customer needs.

Integrating Bookafy Into Your Business

Integrating Bookafy into your business is a simple and straightforward process. Bookafy can be easily integrated into existing customer booking and scheduling processes, allowing companies to quickly and easily get up and running. The tool can also be customized to suit the unique needs of your business, allowing companies to tailor the customer booking and scheduling process to their specific requirements.

Enhancing the Customer Experience With Bookafy

Bookafy can also be used to enhance the customer experience in a number of ways. Customers can easily book appointments from any device, allowing them to book appointments when and where it is most convenient for them. In addition, Bookafy provides customers with the ability to set reminders for their appointments, ensuring that they never miss an appointment.

Data Security and Compliance

The data security and compliance of Bookafy is of the utmost importance. Bookafy is compliant with all relevant privacy regulations and industry standards, ensuring that customer data is always kept secure. The tool also provides companies with the ability to set up two-factor authentication and other security measures to further protect customer data.

The Bottom Line

Bookafy is an incredibly powerful and versatile tool that can help consumer finance companies take their business to the next level. The tool can help streamline customer booking and scheduling processes, optimize business operations, and enhance the customer experience. In addition, Bookafy is compliant with all relevant privacy regulations and industry standards, ensuring that customer data is always kept secure.