Introduction

The digital age has brought an unprecedented level of convenience to how businesses operate, and loan counselors are no exception. Through the use of online appointment scheduling, loan counselors can optimize their business and make it run more efficiently. In this article, we’ll look at how loan counselors can benefit from using the appointment scheduling software Bookafy.

The Benefits of Bookafy

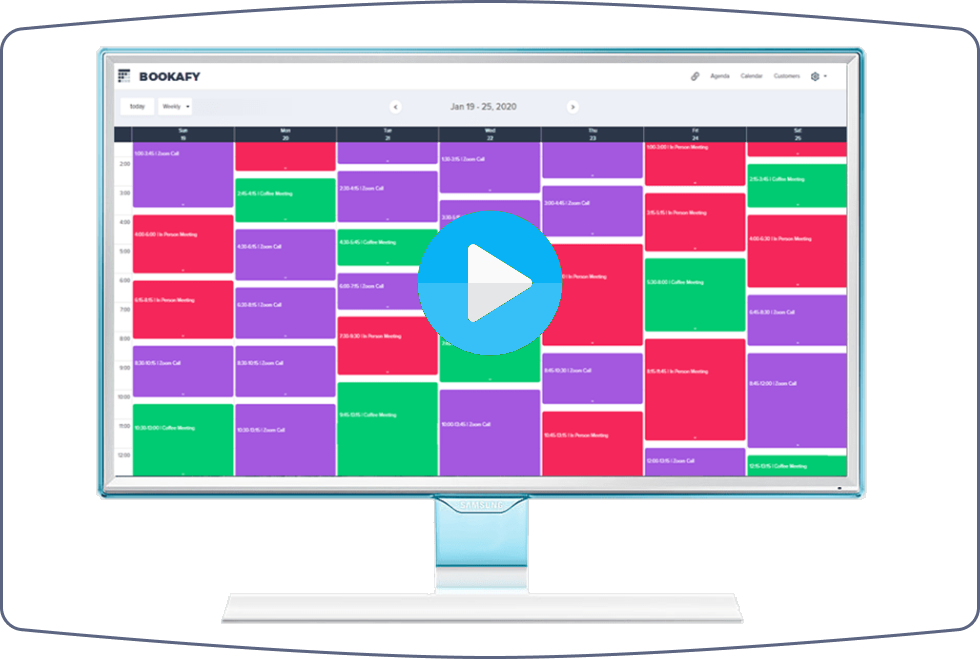

Bookafy is a cloud-based appointment scheduling software that allows loan counselors to create and manage client appointments, as well as customize and accept payments. It offers a wide range of features that help loan counselors to streamline their business operations, such as automated reminder emails and customizable appointment types.

Automated Reminders

Bookafy’s automated reminders can be set up to send clients emails, texts, or both to remind them of upcoming appointments. This eliminates the need for loan counselors to manually contact clients to remind them of appointments, saving time and ensuring that clients don’t miss their appointments.

Customizable Appointment Types

Bookafy allows loan counselors to customize the types of appointments they offer, such as one-on-one consultations, group seminars, and webinars. This allows loan counselors to offer a range of services to their clients and optimize their operations.

Optimizing Business with Bookafy

Bookafy can be used to help loan counselors optimize their business in a variety of ways.

Leverage Data

Bookafy’s analytics feature allows loan counselors to track their bookings, appointment types, and payment data. This data can be used to analyze and optimize their operations, such as by identifying the most popular appointment types or adjusting prices to maximize profitability.

Automate Tasks

Bookafy’s automated features can help loan counselors save time by automating routine tasks such as client reminders and appointment confirmations. By automating these tasks, loan counselors can free up more time to focus on other aspects of their business.

Increase Flexibility

Bookafy allows loan counselors to offer a range of appointment types and payment options, giving clients more flexibility in how they book and pay for appointments. This can help to boost customer satisfaction and loyalty, as well as build trust in the loan counselor’s business.

Conclusion

Online appointment scheduling software has become an invaluable tool for loan counselors, and Bookafy is one of the most comprehensive solutions available. It offers a wide range of features that can help loan counselors to optimize their business, such as automated reminders, customizable appointment types, and data analytics. By leveraging the power of Bookafy, loan counselors can maximize their efficiency and increase their customer satisfaction.