Banks Can Use Bookafy to Streamline Appointment Scheduling

The banking industry is highly competitive and staying ahead of the competition can be difficult. It’s essential to constantly be looking for ways to make the customer experience as smooth and efficient as possible. Online appointment scheduling with Bookafy is a great way for banks to optimize their business and create an intuitive customer experience.

The Benefits of Using Bookafy for Appointment Scheduling

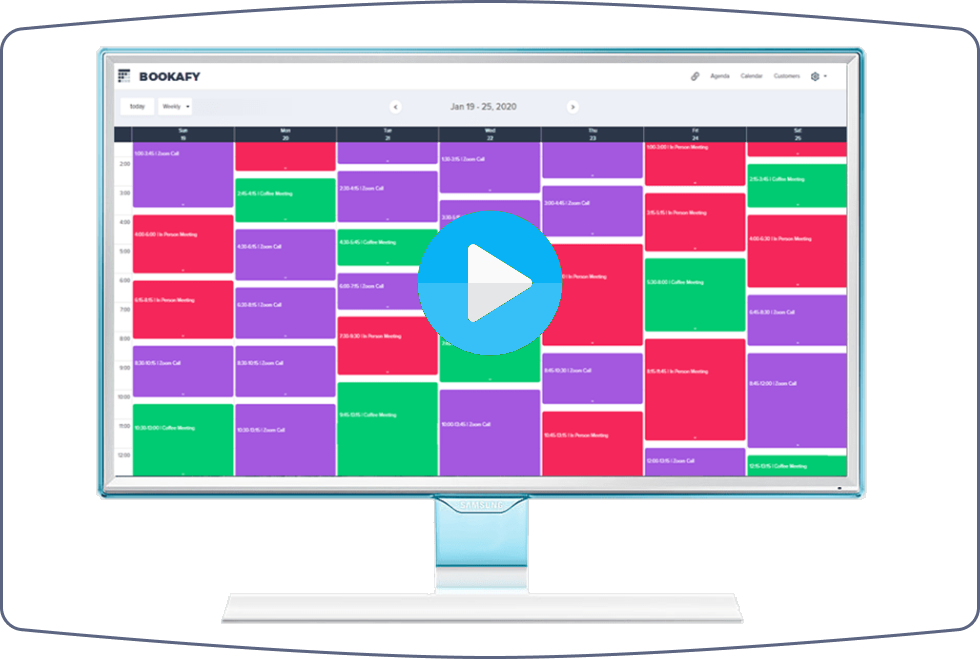

Using Bookafy for appointment scheduling in the banking industry offers a number of benefits. It is an easy-to-use platform that allows customers to quickly and conveniently schedule appointments. Customers can easily pick a date and time that works for them, and banking staff can be instantly notified when an appointment is booked. This increase in efficiency and productivity can greatly reduce wait times and improve customer satisfaction.

Bookafy also offers a powerful back-end system where banking staff can keep track of all upcoming appointments. This allows them to always be prepared and ensures that customer needs are met in a timely manner.

Implementing Bookafy Into Banking Practices

When implementing Bookafy into banking practices, it is important to create an intuitive process that customers can easily understand. The booking process should be simple and straightforward, with clear instructions and step-by-step instructions for customers. It is also a good idea to make sure that customers are aware of the appointment scheduling feature and how to access it. Banks can do this by including links to the Bookafy platform on their website, in emails, and on social media.

Banking staff should also be trained on how to use the Bookafy platform. They should be aware of all the features and how to manage appointments and customer information. This will ensure that customer service is provided in a timely and efficient manner.

The Benefits of Online Appointment Scheduling for Banks

Online appointment scheduling provides a number of benefits to banks. It allows customers to quickly and easily book an appointment without having to wait on hold or spend time explaining their needs to customer service representatives. This increases efficiency and customer satisfaction.

Banks also benefit from the increased productivity that comes with online appointment scheduling. With Bookafy, banking staff can quickly view upcoming appointments and customer information. This allows them to always be prepared and ensures that customer needs are met in a timely manner.

Leveraging Online Appointment Scheduling to Increase Customer Satisfaction

Using Bookafy to schedule appointments is a great way for banks to increase customer satisfaction. Customers are able to quickly and conveniently book an appointment that works for them, which reduces wait times and improves the overall customer experience. It also provides customers with a sense of control, as they can easily view upcoming appointments and reschedule if needed.

Banks can also use Bookafy to send automated reminders to customers about upcoming appointments. This helps ensure that customers do not forget or miss their appointment, which leads to increased customer satisfaction.

Enhancing the Banking Experience With Online Appointment Scheduling

Online appointment scheduling is a great way for banks to enhance the customer experience. It allows customers to quickly and conveniently book an appointment that works for them. Banks can also leverage Bookafy to send automated reminders and notifications to customers about upcoming appointments. This helps ensure that customers are always informed and do not miss their appointment.

Technology Solutions for the Banking Industry

Technology solutions such as Bookafy can help banks optimize their business practices and create an efficient customer experience. Online appointment scheduling allows customers to quickly and conveniently book an appointment that works for them. Banks also benefit from increased productivity and customer satisfaction.

Why Banks Should Prioritize Online Appointment Scheduling

Online appointment scheduling is a must-have for banks that want to stay competitive. It allows customers to quickly and conveniently book an appointment, which reduces wait times and improves customer satisfaction. Banks also benefit from increased productivity and efficiency.

Implementing Bookafy Into Your Banking Practices

Bookafy is a great way for banks to optimize their business practices and create an efficient customer experience. When implementing Bookafy, it’s important to ensure that customers are aware of the appointment scheduling feature and how to access it. Banks can do this by including links to the Bookafy platform on their website, in emails, and on social media. Banking staff should also be trained on how to use the Bookafy platform.

Making the Most of Online Appointment Scheduling

Banks can make the most of online appointment scheduling by leveraging features such as automated reminders and notifications. This helps ensure that customers are always informed and do not miss their appointment. Banks should also make sure that customers have a clear understanding of the appointment scheduling process and how to access it.

The Future of Appointment Scheduling in the Banking Industry

Online appointment scheduling is quickly becoming the norm in the banking industry. Banks that leverage this technology can quickly optimize their business practices and provide customers with a more efficient and enjoyable experience. As technology continues to advance, it is likely that more and more banks will implement online appointment scheduling solutions such as Bookafy.

Conclusion

Online appointment scheduling is an essential tool for banks that want to stay competitive. Bookafy provides a powerful and easy-to-use platform that allows customers to quickly and conveniently book an appointment. Banks also benefit from increased productivity and customer satisfaction. Implementing Bookafy into banking practices is a great way for banks to optimize their business and create an efficient customer experience.