The Benefits of Using Bookafy in the Reinsurance Industry

Reinsurance is a complex world that can often benefit from modern technology. Bookafy offers a great online appointment scheduling tool that can help simplify the reinsurance industry. Here are some of the benefits of using Bookafy to optimize operations.

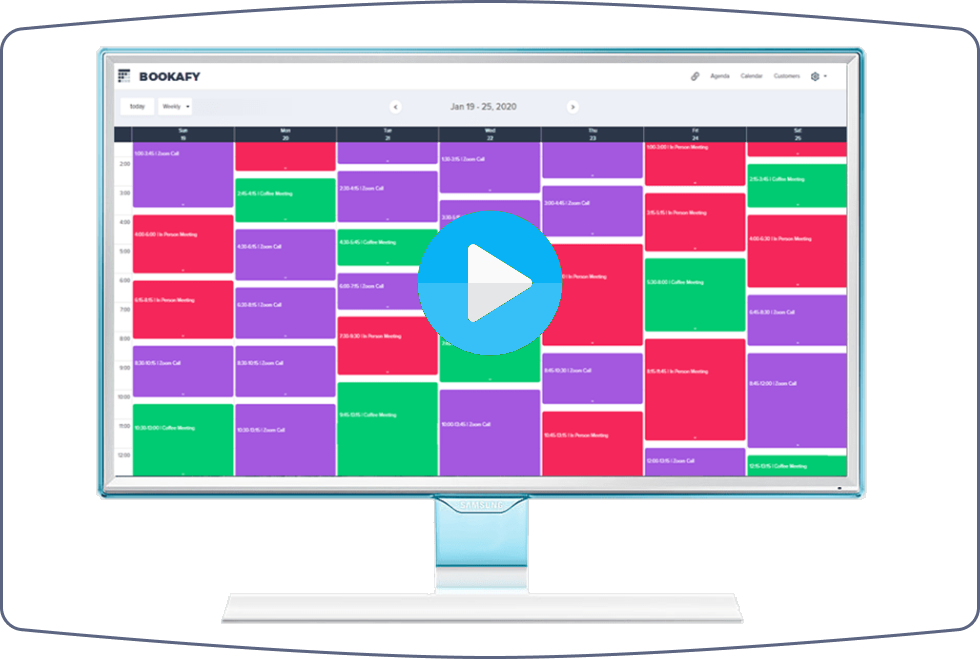

Streamlined Operations

Bookafy makes scheduling and rescheduling appointments easy. With one click, you can schedule an appointment with a client, set up a meeting with your team, or even send out reminders to clients about an upcoming appointment. This simple system makes it easy to ensure that appointments are never missed and that operations are running smoothly.

Bookafy can also help streamline communication. Instead of relying on emails, texts, and phone calls, users can be informed of any changes in real-time. This helps to minimize unnecessary back and forth communication and ensures everyone is always on the same page.

Reduce Overhead Costs

Bookafy’s online appointment scheduling tools can help reduce overhead costs for reinsurance companies. With automated reminders, fewer no-shows and fewer missed appointments, companies can save time and money.

Bookafy also eliminates the need for a dedicated appointment booker. With an automated system, employees can set up their own appointments and reschedule them as needed. This eliminates the need to hire someone specifically to manage appointments and can help reduce costs.

Optimize Your Client Relationships

Bookafy makes it easy to keep track of client information. You can store information such as contact details, preferred communication methods, and even payment information. This makes it easier to keep track of your clients, their preferences, and their history of transactions.

Bookafy also helps to keep client relationships strong. With automated reminders, clients are more likely to show up to their appointments. This helps to maintain a strong relationship between the company and its clients.

Enhanced Security

Bookafy offers an enhanced level of security for your data. All data is encrypted and stored securely on the cloud. This ensures that no one can access your data without the proper authentication.

Bookafy also offers two-factor authentication. This adds an extra layer of security and helps to ensure that only authorized personnel can access the data.

Easy Payment Processing

Bookafy makes payment processing easy. With just a few clicks, you can set up a payment form for your clients. This makes it easy for clients to make payments quickly and securely.

Bookafy also integrates with major payment processors such as Stripe and PayPal. This makes it easy to accept payments from all major credit cards, debit cards, and even digital wallets.

Eliminate Paperwork

Bookafy helps to eliminate paperwork by allowing you to store all relevant information online. No more physical files or paper contracts. Everything can be stored in the cloud and accessed whenever needed.

Bookafy also allows you to generate documents such as invoices, receipts, contracts, and more. This eliminates the need for manually filling out paperwork and helps to streamline operations.

Analytics and Reporting

Bookafy offers analytics and reporting that can help you track your performance. You can track customer trends, appointment schedules, and more. This can help you to identify areas of improvement and optimize your operations.

Bookafy also offers customizable reports. This makes it easy to generate reports that illustrate your performance and help you to make better decisions.

The Benefits of Using Bookafy in the Reinsurance Industry

Bookafy offers a great solution for reinsurance companies. It helps to streamline operations, reduce overhead costs, optimize client relationships, and enhance security. It also makes it easy to accept payments, eliminates paperwork, and provides analytics and reporting. Overall, Bookafy is a great way to make operations easier and more efficient in the reinsurance industry.